Supply Chain Disruptions: Lessons Learned Across Industries

Over the past few years, supply chains across the globe have faced unprecedented disruption. From pandemics and geopolitical tensions to energy shocks and climate-related events, businesses across industries have learned a hard lesson: efficiency alone is no longer enough.

What once worked—lean inventories, single-source suppliers, and just-in-time models—has proven vulnerable in an increasingly volatile world. As a result, organizations across manufacturing, healthcare, retail, energy, and technology are rethinking how supply chains are designed, managed, and future-proofed.

The Common Drivers Behind Supply Chain Disruptions

While disruption events differ by industry, their root causes are often shared:

Over-concentration of suppliers in a single geography

Logistics bottlenecks across ports, shipping, and last-mile delivery

Energy price volatility affecting production and transportation costs

Regulatory and trade restrictions impacting cross-border flows

Limited visibility beyond Tier-1 suppliers

These factors exposed structural weaknesses that had been masked during periods of stable global trade.

Key Lessons Learned Across Industries

1. Resilience Matters as Much as Cost Efficiency

Industries that prioritized lowest-cost sourcing often experienced the most severe disruptions. The lesson is clear: resilience must be built into supply chain design.

Companies are now balancing cost optimization with:

Multi-sourcing strategies

Regional and near-shore manufacturing

Strategic safety stock for critical components

This shift does not eliminate efficiency—but reframes it through a risk-adjusted lens.

2. Visibility Is the Foundation of Control

Across industries, lack of real-time visibility proved to be a major weakness. Organizations that could not track inventory, supplier capacity, or logistics status were slower to respond.

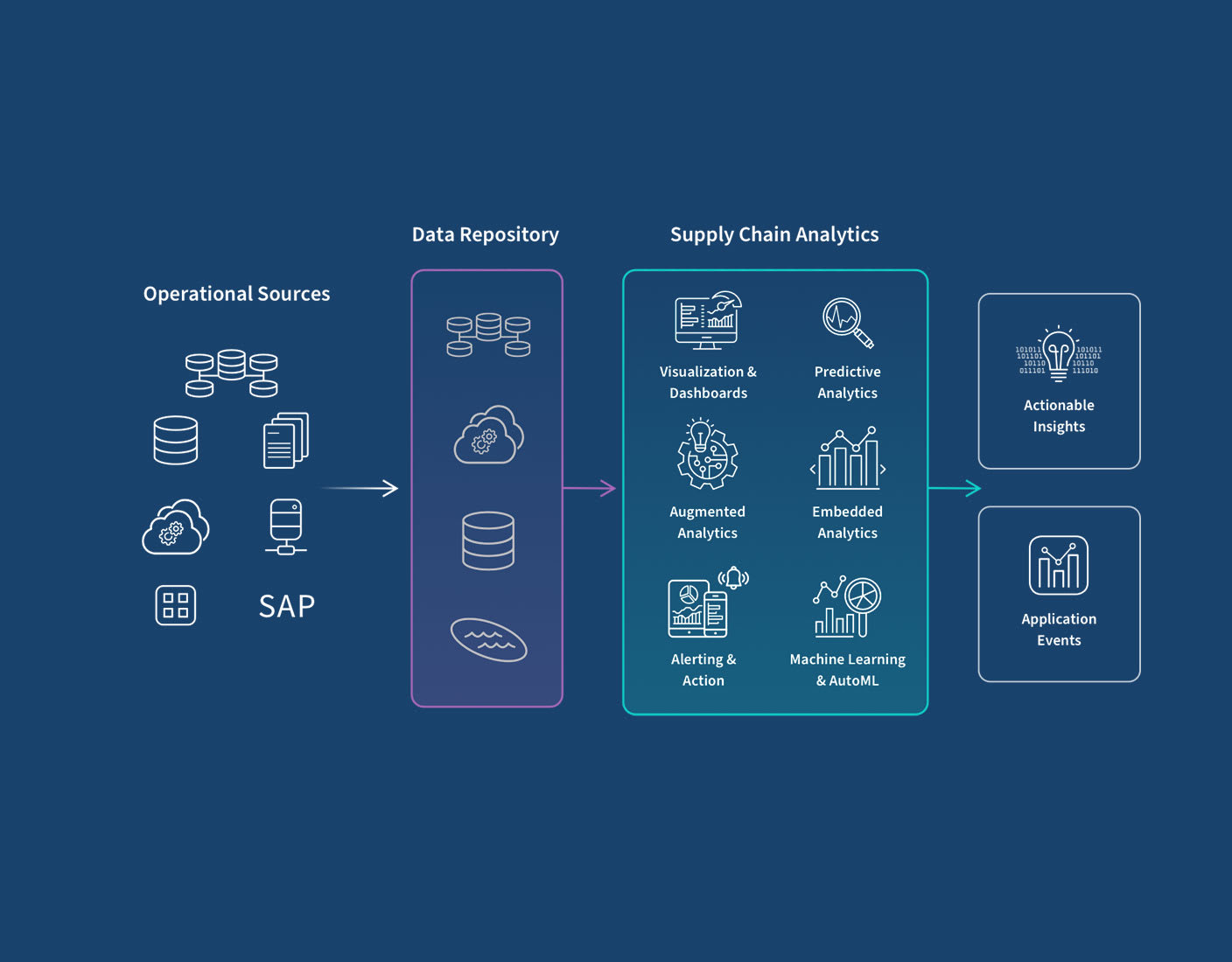

As a result, businesses are investing in:

End-to-end supply chain visibility platforms

Data integration across suppliers and logistics partners

Predictive analytics to anticipate disruptions

Visibility has become the prerequisite for agility.

3. Supplier Relationships Are Strategic Assets

Transactional supplier relationships failed under stress. In contrast, companies with collaborative, long-term partnerships were better able to secure supply, renegotiate timelines, and manage shortages.

Leading organizations are now:

Reducing supplier fragmentation

Engaging in joint planning and forecasting

Sharing demand and inventory data

Supplier strategy is evolving from procurement-driven to partnership-driven.

4. Digitalization Is No Longer Optional

Manual planning processes and spreadsheet-based forecasting struggled to keep pace with disruption. Industries that had already adopted digital supply chain tools responded faster and more effectively.

Digital capabilities now focus on:

Scenario modeling and stress testing

AI-driven demand forecasting

Automated replenishment and exception management

Digital supply chains are proving more adaptive under uncertainty.

5. Inventory Strategy Needs a Rethink

The “zero-inventory” mindset has been widely reassessed. While excess inventory carries cost, insufficient inventory carries risk.

Industries are adopting:

Segmented inventory strategies based on criticality

Dynamic safety stock models

Better alignment between sales, operations, and finance

Inventory is increasingly viewed as a risk buffer, not just a cost line.

Industry-Specific Takeaways

Manufacturing: Dual sourcing and regional hubs reduce dependency risk

Healthcare & Pharma: Supply assurance is critical for patient safety, not just margins

Retail & FMCG: Demand volatility requires faster sensing and flexible fulfillment

Energy & Infrastructure: Long lead times demand early risk identification and supplier stability

Technology: Component shortages highlight the need for design flexibility and supplier diversity

Despite sector differences, the strategic direction remains consistent.

Building the Supply Chains of the Future

The next generation of supply chains will be:

More regionalized, balancing global scale with local resilience

Data-driven, supported by real-time analytics and forecasting

Collaborative, integrating suppliers, logistics partners, and customers

Risk-aware, with built-in contingency planning

Rather than optimizing for a single scenario, companies are preparing for multiple possible futures.

Conclusion

Supply chain disruptions have permanently changed how organizations think about sourcing, logistics, and operations. The biggest lesson across industries is simple: resilience is not a temporary fix—it is a strategic capability.

Companies that apply these lessons will not only withstand future disruptions but gain a competitive advantage in an increasingly uncertain global environment.