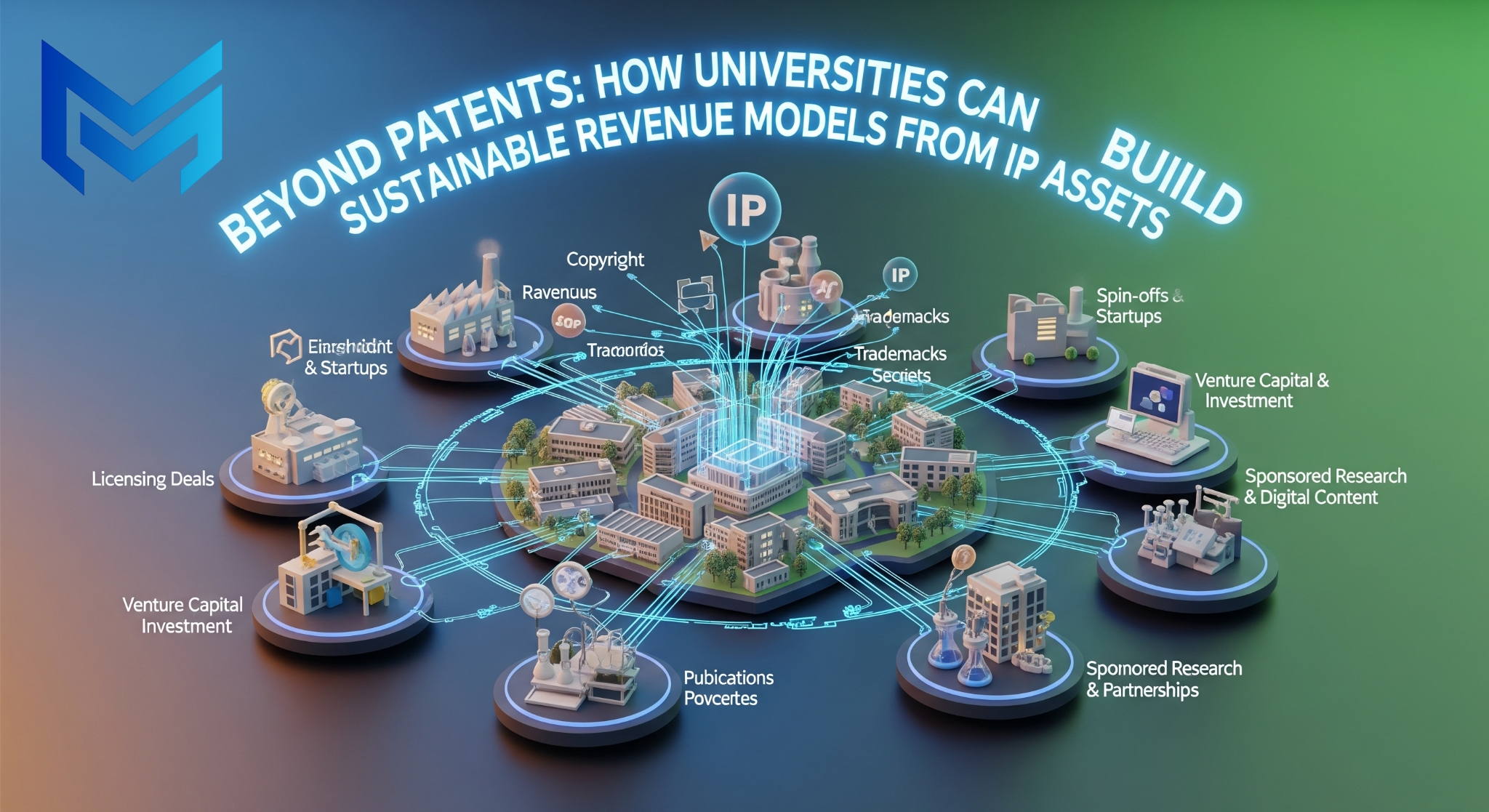

Beyond Patents: How Universities Can Build Sustainable Revenue Models from IP Assets

For decades, universities have been engines of innovation producing breakthrough research in life sciences, engineering, AI, clean energy, and advanced materials. Yet despite generating vast intellectual property (IP), many universities struggle to convert these assets into sustainable and scalable revenue streams.

The traditional approach to IP monetization primarily focused on patent filing and one-off licensing—has proven insufficient in today’s fast-moving, innovation-driven economy. Filing patents is no longer enough. Universities must think beyond patents and adopt diversified, business-oriented IP strategies that align academic research with market demand.

This article explores how universities can move from passive IP ownership to active IP value creation, building long-term, resilient revenue models that support research funding, institutional growth, and societal impact.

The University IP Monetization Challenge

Universities globally invest heavily in research and development, often supported by government grants, public funding, and industry collaboration. However, the return on this investment through IP commercialization remains uneven.

Common challenges include:

Low licensing conversion rates despite large patent portfolios

Overemphasis on patent counts rather than commercial relevance

Limited industry engagement during early research stages

Under-resourced Technology Transfer Offices (TTOs)

Long commercialization timelines, especially in deep tech and life sciences

As a result, many valuable innovations remain underutilized—protected on paper but dormant in practice.

The core issue is not a lack of innovation, but a misalignment between academic IP generation and market-driven value creation.

Why Patents Alone Are Not a Revenue Strategy

Patents are foundational to IP protection, but they are not inherently revenue-generating assets. A patent only creates value when it:

Solves a real market problem

Fits into a viable commercial product or service

Is adopted by industry or commercialized through a startup

In reality, a significant percentage of university patents are never licensed, and even fewer generate meaningful royalty income. Moreover, reliance on licensing revenue alone is risky due to:

Long negotiation cycles

Uncertain adoption by licensees

Revenue concentration in a few “blockbuster” patents

To build sustainable revenue models, universities must adopt a portfolio-based, multi-channel approach to IP commercialization.

Rethinking IP as a Strategic Business Asset

Forward-thinking universities are redefining IP not as a legal artifact, but as a strategic business asset. This mindset shift enables institutions to design monetization pathways based on:

Market readiness

Industry demand

Technology maturity (TRL levels)

Risk and return profiles

Instead of asking, “How do we license this patent?”, universities must ask:

“What is the best commercial pathway for this IP to create long-term value?”

Diversified Revenue Models Beyond Traditional Licensing

1. Startup and Spin-Off Creation

One of the most powerful ways to unlock IP value is through university spin-offs and startups. Rather than licensing IP outright, universities can:

Contribute IP as equity

Retain ownership stakes

Participate in long-term upside through exits or dividends

This model is especially effective for:

Deep tech innovations

Platform technologies

Life sciences and biotech discoveries

While startups carry higher risk, they also offer exponential value creation compared to capped royalty streams.

Key success factors include:

Strong founder support and incubation programs

Access to venture capital and industry mentors

Clear IP ownership and equity frameworks

2. IP-Backed Strategic Partnerships

Instead of transactional licensing, universities can form long-term strategic partnerships with corporations. These partnerships may include:

Co-development agreements

Joint IP ownership

Milestone-based commercialization payments

Sponsored research linked to commercialization rights

Such models provide recurring revenue, deeper industry engagement, and better alignment between research output and market needs.

3. Platform and Portfolio Licensing

Rather than licensing individual patents, universities can bundle related IP into technology platforms or portfolios. This approach:

Increases negotiating power

Reduces dependency on single patents

Enhances perceived commercial value

For example, a portfolio covering multiple aspects of a drug delivery system or AI algorithm suite is far more attractive than isolated filings.

4. Data, Know-How, and Trade Secrets

Not all valuable IP is patentable—or should be patented. Universities possess immense value in the form of:

Research data sets

Algorithms and models

Experimental protocols

Manufacturing know-how

Monetizing non-patent IP through controlled access, subscriptions, or partnerships can generate faster and more predictable revenue while avoiding patent costs.

5. Continuing Education and IP-Driven Training Programs

Universities can monetize IP indirectly by embedding it into:

Executive education programs

Professional certification courses

Industry training workshops

This approach creates recurring income while strengthening industry relationships and positioning the university as a thought leader.

Building a Market-Driven Technology Transfer Office (TTO)

A sustainable IP revenue strategy requires a modernized Technology Transfer Office that functions more like a business development unit than a legal department.

Key capabilities include:

Market assessment and competitive analysis

IP valuation and pricing strategy

Industry outreach and deal structuring

Startup incubation and investor engagement

Universities that invest in commercially skilled TTO teams consistently outperform peers in IP monetization outcomes.

Aligning Incentives for Faculty and Researchers

Faculty engagement is critical to commercialization success. However, misaligned incentives often discourage participation.

Best practices include:

Transparent and attractive revenue-sharing models

Recognition of commercialization in tenure and promotion decisions

Entrepreneurial sabbaticals and startup support

When researchers see IP commercialization as an extension of their academic impact—not a distraction—participation increases dramatically.

Leveraging External Partners for IP Commercialization

Many universities lack the internal resources to commercialize IP at scale. Strategic use of external IP commercialization partners can bridge this gap by providing:

Market intelligence and IP landscaping

Licensing and negotiation expertise

Startup acceleration support

Global industry connections

Such partnerships allow universities to focus on research excellence while accelerating revenue realization.

Measuring Success Beyond Short-Term Revenue

Sustainable IP revenue models require long-term performance metrics, not just annual licensing income.

Key indicators include:

Portfolio utilization rate

Number of active industry partnerships

Startup survival and exit rates

Research reinvestment enabled by IP income

By tracking impact alongside income, universities can build resilient commercialization ecosystems.

The Future of University IP Monetization

As innovation cycles shorten and competition intensifies, universities must evolve from patent generators to innovation enterprises. The future belongs to institutions that:

Integrate commercialization early in the research lifecycle

Treat IP as a dynamic asset portfolio

Build ecosystems—not just deals

Those that move beyond patents will not only generate sustainable revenue but also amplify their role as catalysts of economic and societal progress.

Conclusion

Patents remain an essential foundation of intellectual property strategy, but they are only the beginning. To build sustainable, diversified revenue models, universities must embrace a broader view of IP—one that prioritizes market relevance, strategic partnerships, and long-term value creation.

By rethinking how IP is developed, managed, and commercialized, universities can transform dormant inventions into enduring sources of revenue, innovation, and impact