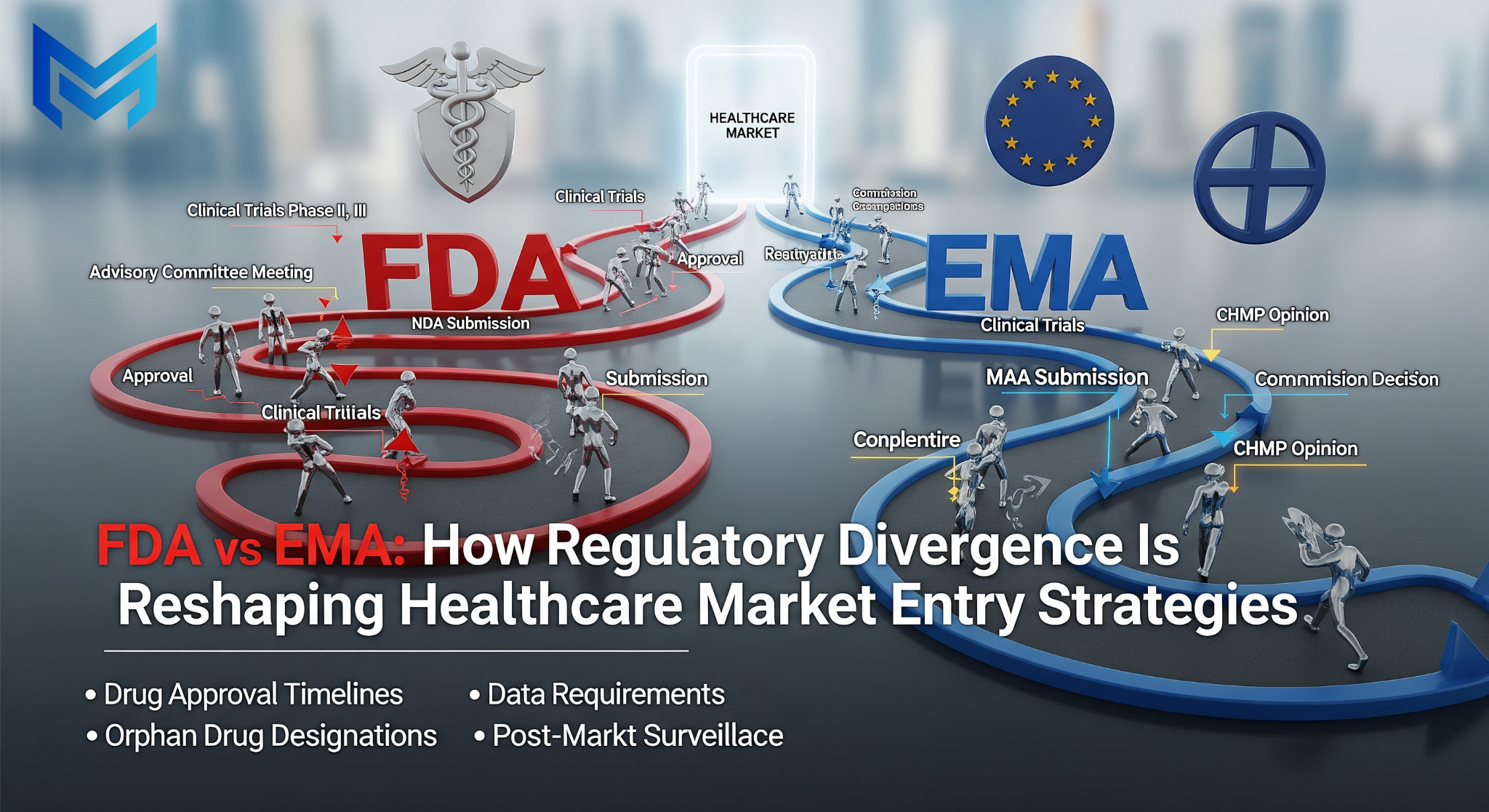

FDA vs EMA: How Regulatory Divergence Is Reshaping Healthcare Market Entry Strategies

For healthcare and pharmaceutical companies, regulatory approval was once the primary milestone on the path to commercial success. Today, however, approval alone no longer guarantees market access—especially when navigating the growing divergence between the FDA and the EMA.

As the United States and Europe follow increasingly different regulatory, evidence, and post-approval expectations, companies are being forced to rethink how, when, and where they enter healthcare markets.

The Growing Divide Between FDA and EMA

While both agencies share the goal of patient safety and therapeutic efficacy, their regulatory philosophies and execution models are moving in different directions.

FDA (United States):

Faster pathways through accelerated and breakthrough designations

Greater reliance on real-world evidence (RWE) post-approval

Strong emphasis on commercial value demonstration to payers

EMA (European Union):

More cautious and consensus-driven approval timelines

Heavy scrutiny around comparative effectiveness

Fragmented post-approval access shaped by country-level HTA bodies

The result? A product approved in the US may still face long delays, price erosion, or limited access across Europe.

Why “One Global Strategy” No Longer Works

Many healthcare companies still attempt to deploy a single, global regulatory and launch strategy. This approach increasingly leads to:

Overestimated European revenue projections

Misaligned clinical endpoints for HTA requirements

Delays between regulatory approval and real market uptake

In Europe, approval is only the first hurdle. Pricing negotiations, reimbursement decisions, and local adoption can vary dramatically between Germany, France, Italy, Spain, the Nordics, and the UK.

Market Entry Is Now a Regulatory-Commercial Equation

Regulatory divergence has turned market entry into a combined regulatory + commercial challenge.

Successful companies are now asking:

Will FDA-approved evidence satisfy European HTA expectations?

What additional data will payers demand post-approval?

How will pricing controls impact long-term market sustainability?

Without these answers, even clinically strong products risk underperforming.

The Role of Market Intelligence in Navigating FDA vs EMA Complexity

This is where custom, primary-led market intelligence plays a critical role.

Healthcare leaders need:

✔️ Early insight into regulatory and HTA expectations

✔️ Country-specific access and reimbursement intelligence

✔️ Stakeholder perspectives from physicians, payers, and policy influencers

Understanding how regulators, payers, and prescribers interpret evidence is just as important as generating that evidence.

How Eminent Global Research Solutions Supports Smarter Market Entry

At Eminent Global Research Solutions, we help healthcare and pharmaceutical companies align regulatory strategy with commercial reality across the US and Europe.

Our support includes:

Regulatory-driven market opportunity assessment

FDA vs EMA impact analysis on launch timing and revenue

Primary research with KOLs, payers, and access stakeholders

Scenario-based forecasting for US and EU market entry

Our goal is simple: help decision-makers avoid costly misalignment between approval and access.

Final Takeaway

In today’s healthcare landscape, regulatory approval is no longer the finish line—it’s the starting point.

Companies that succeed across the US and Europe will be those that recognize regulatory divergence early, adapt their market entry strategies accordingly, and ground decisions in real-world market intelligence.